Discover the essential directory of investment companies in Tokyo, where a diverse array of firms is poised to help you navigate the dynamic financial landscape. Whether you are an individual investor or a corporate client, this comprehensive resource provides valuable insights into local investment options. Explore firms specializing in asset management, venture capital, private equity, and financial advisory services. Our curated list includes top-rated investment companies in Tokyo, enabling you to make informed decisions that align with your financial goals. Stay ahead in the competitive market by leveraging expert knowledge and innovative strategies offered by these trusted investment partners.

Investment Companies: Reliable reviews and local favorites

| 🥇1. | Morgan Stanley Japan Headquarters |

| 🥈2. | Argentum Wealth Management |

| 🥉3. | Tyton | Capital Advisors |

| 4. | 株式会社キャプラ・インベストメント・ジャパン |

| 5. | BofA Securities Japan Co., Ltd. |

Discover the best Investment Companies in Tokyo: hours, contact information and customer reviews

Morgan Stanley Japan Headquarters

Morgan Stanley Japan Headquarters, located at 1 Chome-9-7 Ōtemachi, Chiyoda City, Tokyo 100-0004, is a premier investment company with a stellar 5 out of 5 rating. This prestigious firm operates from 9 AM to 5 PM on weekdays, offering a range of services including asset management, financial advisory, and investment banking. Renowned for its expertise in wealth management and innovative financial solutions, Morgan Stanley serves a diverse clientele, ensuring personalized strategies to meet their financial goals. Its strategic position in the heart of Tokyo’s business district makes it an influential player in the financial landscape.

1 Chome-9-7 Ōtemachi, 千代田区 Chiyoda City, Tokyo 100-0004, Japan

+81 3-6836-5000

5/5 (Read reviews)

Sunday: Closed

Monday: 9 AM–5:10 PM

Tuesday: 9 AM–5:10 PM

Wednesday: 9 AM–5:10 PM

Thursday: 9 AM–5:10 PM

Friday: 9 AM–5:10 PM

Saturday: Closed

Argentum Wealth Management

Argentum Wealth Management, located on the 8th floor of the NISSO 22 Building in Azabudai, Minato City, Tokyo, is a highly-rated investment firm boasting an impressive 4.9 out of 5 rating. This firm specializes in personalized wealth management, investment strategies, and financial planning tailored to individual client needs. Open Monday to Friday from 9 AM to 6 PM, Argentum provides expert guidance to help clients navigate the complexities of the financial landscape. Its commitment to excellence and client satisfaction makes it a trusted partner for both individuals and businesses seeking to secure their financial future.

802, NISSO 22 Bldg, 8 Floor, 1 Chome-11-10 Azabudai, Minato City, Tokyo 106-0041, Japan

+81 3-5549-9099

4.9/5 (Read reviews)

Sunday: Closed

Monday: 9:30 AM–6 PM

Tuesday: 9:30 AM–6 PM

Wednesday: 9:30 AM–6 PM

Thursday: 9:30 AM–6 PM

Friday: 9:30 AM–6 PM

Saturday: Closed

Tyton | Capital Advisors

Tyton | Capital Advisors, located at 1 Chome-12-32 Akasaka, Minato City, Tokyo 107-0052, is a premier investment firm renowned for its exceptional service, boasting an impressive 5 out of 5 rating. Open Monday to Friday from 9 AM to 6 PM, it specializes in investment strategies, portfolio management, and financial consulting tailored to meet unique client needs. With a dedicated team of experts, Tyton provides insightful market analysis and personalized advisement, ensuring optimal investment outcomes. Its strategic location in the heart of Tokyo makes it easily accessible for both local and international clients seeking sound financial guidance.

1 Chome-12-32 Akasaka, Minato City, Tokyo 107-0052, Japan

+81 3-4360-9207

5/5 (Read reviews)

Sunday: Closed

Monday: 9 AM–6 PM

Tuesday: 9 AM–6 PM

Wednesday: 9 AM–6 PM

Thursday: 9 AM–6 PM

Friday: 9 AM–6 PM

Saturday: Closed

株式会社キャプラ・インベストメント・ジャパン

Located in the heart of Tokyo at 22F, 1 Chome-3-1 Toranomon, Minato City, 株式会社キャプラ・インベストメント・ジャパン is a reputable investment company with a solid rating of 4 out of 5. Open weekdays from 9 AM to 5 PM, the firm specializes in asset management, strategic investments, and financial advisory services tailored to meet the needs of both individual and institutional clients. With a commitment to delivering innovative investment solutions, it stands out as a key player in the competitive Tokyo financial landscape, making it a trusted partner for those seeking growth and sustainability in their portfolios.

22F, 1 Chome-3-1 Toranomon, Minato City, Tokyo 105-0001, Japan

+81 3-4530-4800

4/5 (Read reviews)

Sunday: Closed

Monday: 8 AM–6 PM

Tuesday: 8 AM–6 PM

Wednesday: 8 AM–6 PM

Thursday: 8 AM–6 PM

Friday: 8 AM–6 PM

Saturday: Closed

BofA Securities Japan Co., Ltd.

BofA Securities Japan Co., Ltd. is a prominent investment company located in the heart of Tokyo at 1 Chome−4−1 Nihonbashi, Mitsui Building, 6F, Chuo City, 〒103-0027. With a rating of 3.9 out of 5, the firm specializes in providing a range of financial services, including investment banking, asset management, and market research. BofA Securities is committed to delivering strategic solutions to its clients, making it a key player in the Japanese financial landscape. The office operates during standard business hours, offering professional guidance to local and international investors alike.

Japan, 〒103-0027 Tokyo, Chuo City, Nihonbashi, 1 Chome−4−1 Nihonbashi 1-chome Mitsui Building, 6F

+81 3-6225-7000

3.9/5 (Read reviews)

Open 24 hours, 7 days a week

Imperial Hotel Tower

The Imperial Hotel Tower, located at 1 Chome-1 Uchisaiwaicho in Chiyoda City, Tokyo, is a prominent investment company with a strong reputation, boasting a rating of 4.3 out of 5. Operating daily from 9:00 AM to 6:00 PM, it offers specialized financial services, including asset management, investment consulting, and strategic advisory. The hotel’s elegant atmosphere complements its professional environment, making it a favored choice for clients seeking reliable investment solutions. With its central location, it serves as an ideal hub for business meetings and networking events in Tokyo.

1 Chome-1 Uchisaiwaicho, Chiyoda City, Tokyo 100-0011, Japan

+81 3-3507-5681

Australia Investment – UCHK Japan

Australia Investment – UCHK Japan, located on the 28th floor of the Ark Hills Sengokuyama Mori Tower in Roppongi, Minato-ku, is a premier investment company with an impeccable 5 out of 5 rating. Offering a range of services including asset management, market analysis, and strategic investment consulting, the firm specializes in fostering growth opportunities for clients. Open Monday to Friday from 9 AM to 6 PM, Australia Investment prioritizes personalized client relationships and innovative financial solutions, making it a trusted partner for both individual investors and businesses seeking to expand their portfolios in Japan and beyond.

Ark Hills Sengokuyama Mori Tower, 28th Floor 1-9-10,, Roppongi, Minato-ku,, 2, Tokyo, 106-0032, Japan

+81 50-5532-5113

5/5 (Read reviews)

Sunday: Closed

Monday: 9 AM–12 AM

Tuesday: 12–6 AM, 9 AM–12 AM

Wednesday: 12–6 AM, 9 AM–12 AM

Thursday: 12–6 AM, 9 AM–12 AM

Friday: 12–6 AM, 9 AM–12 AM

Saturday: 12–6 AM

Man Group Japan Limited Tokyo Branch

Man Group Japan Limited’s Tokyo Branch is situated on the 27th floor of the Akasaka Biz Tower in the heart of Minato City. Operating within a prime financial district, this investment firm specializes in a wide array of asset management services, catering to institutional and individual investors alike. While currently holding a rating of 0 out of 5, the branch strives to offer innovative investment solutions tailored to meet diverse client needs. The office is typically open during standard business hours, providing a professional environment for potential clients seeking expertise in the investment sector.

Akasaka Biz Tower, 27th Floor, 5 Chome-3-1 Akasaka, Minato City, Tokyo 107-6327, Japan

+81 3-6441-2460

0/5 (Read reviews)

Open 24 hours, 7 days a week

ベインキャピタル・ジャパン

Located in the prestigious Marunouchi area of Tokyo, ベインキャピタル・ジャパン (Bain Capital Japan) is a top-tier investment company known for its exceptional performance, boasting a perfect 5 out of 5 rating. Situated on the 5th floor of the Palace Building at 1 Chome−1−1, Chiyoda City, 〒100-0005, Bain Capital specializes in private equity, venture capital, and credit management. Adhering to a client-focused approach, it provides tailored investment strategies that empower businesses to achieve sustainable growth. The firm’s commitment to excellence and innovation positions it as a leading player in Japan’s investment landscape.

Japan, 〒100-0005 Tokyo, Chiyoda City, Marunouchi, 1 Chome−1−1 Palace Building, 5F

+81 3-6212-7070

Marunouchi Capital Co., Ltd.

Marunouchi Capital Co., Ltd., located at 2 Chome-7-2 Marunouchi, Chiyoda City, Tokyo 100-7011, is a highly regarded investment firm, boasting a perfect 5 out of 5 rating. Operating during regular business hours, the company specializes in asset management, venture capital, and strategic investment solutions tailored to meet diverse client needs. With a focus on innovative financial strategies and exceptional client service, Marunouchi Capital has established itself as a trusted partner for individuals and businesses looking to grow their investments in Japan’s dynamic market. Its prime location in the heart of Tokyo enhances accessibility and networking opportunities.

2 Chome-7-2 Marunouchi, Chiyoda City, Tokyo 100-7011, Japan

+81 3-6212-6400

5/5 (Read reviews)

Sunday: 9:15 AM–5:30 PM

Monday: 9:15 AM–5:30 PM

Tuesday: 9:15 AM–5:30 PM

Wednesday: 9:15 AM–5:30 PM

Thursday: 9:15 AM–5:30 PM

Friday: 9:15 AM–5:30 PM

Saturday: 9:15 AM–5:30 PM

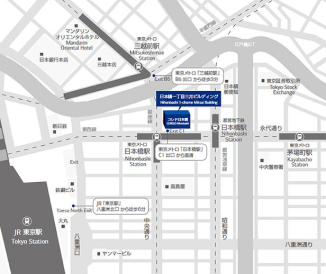

Map of Investment Companies in Tokyo

Unlocking Financial Success: Essential Tips for Choosing the Best Investment Companies in Tokyo

When searching for the best investment companies in Tokyo, it’s vital to consider a few key factors. First, research the company’s reputation and track record; reputable firms often have positive client reviews and transparent performance history. Second, evaluate their investment strategies to ensure they align with your financial goals and risk tolerance. It’s also crucial to look for firms that offer personalized services tailored to your individual needs. Check if they provide access to a diverse range of investment options, including stocks, bonds, and real estate. Lastly, don’t forget to assess their fees and commissions, as these can significantly impact your returns over time. Taking the time to analyze these aspects will help you make an informed decision and lead to a fruitful investment experience.

Understanding Investment Company Costs in Tokyo: What You Need to Know

When considering investment companies in Tokyo, it’s essential to be aware of the diverse cost structures associated with their services. Typically, fees can range from 1% to 2% of assets under management annually, depending on the firm’s reputation and the complexity of services offered. Additionally, many companies may charge transaction fees or performance-based fees, which can further impact your overall investment costs. It’s advisable to conduct thorough research and compare different firms to find the right balance between quality service and affordable pricing.

User Questions

What are investment companies in Tokyo?

Investment companies in Tokyo are financial institutions that pool funds from investors to invest in various securities, such as stocks and bonds. They provide a way for individuals to diversify their investments and access professional management.

How can I choose the right investment company in Tokyo?

To choose the right investment company, consider factors like investment strategies, fees, past performance, and the company’s reputation. It’s also advisable to check if they are registered with the Financial Services Agency in Japan.

What regulations govern investment companies in Tokyo?

Investment companies in Tokyo are primarily regulated by the Financial Instruments and Exchange Act (FIEA) and must comply with rules set forth by the Financial Services Agency (FSA). These regulations ensure transparency and protect investors’ interests.

Can foreign investors invest in Japanese investment companies?

Yes, foreign investors can invest in Japanese investment companies, provided they comply with local regulations. It is essential for them to understand the tax implications and any potential currency risks involved in their investments.

[cluster padre=’finance‘ numero=’9′ tag=’62’]